Property Tax Rate Butler County Pa . The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. Welcome to the butler county property and revenue department webpage! Current taxes due in the districts for which the. Delinquent taxes due county wide. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The property and revenue office generates over 30 million. The assessment department generates the property tax bills for the county, municipalities, and school districts. The following tax types are shown as a result of a search: See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. The county and municipal property tax bills are sent out on march.

from wcfcourier.com

Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. Current taxes due in the districts for which the. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The property and revenue office generates over 30 million. The assessment department generates the property tax bills for the county, municipalities, and school districts. Delinquent taxes due county wide. The county and municipal property tax bills are sent out on march. Welcome to the butler county property and revenue department webpage! Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how.

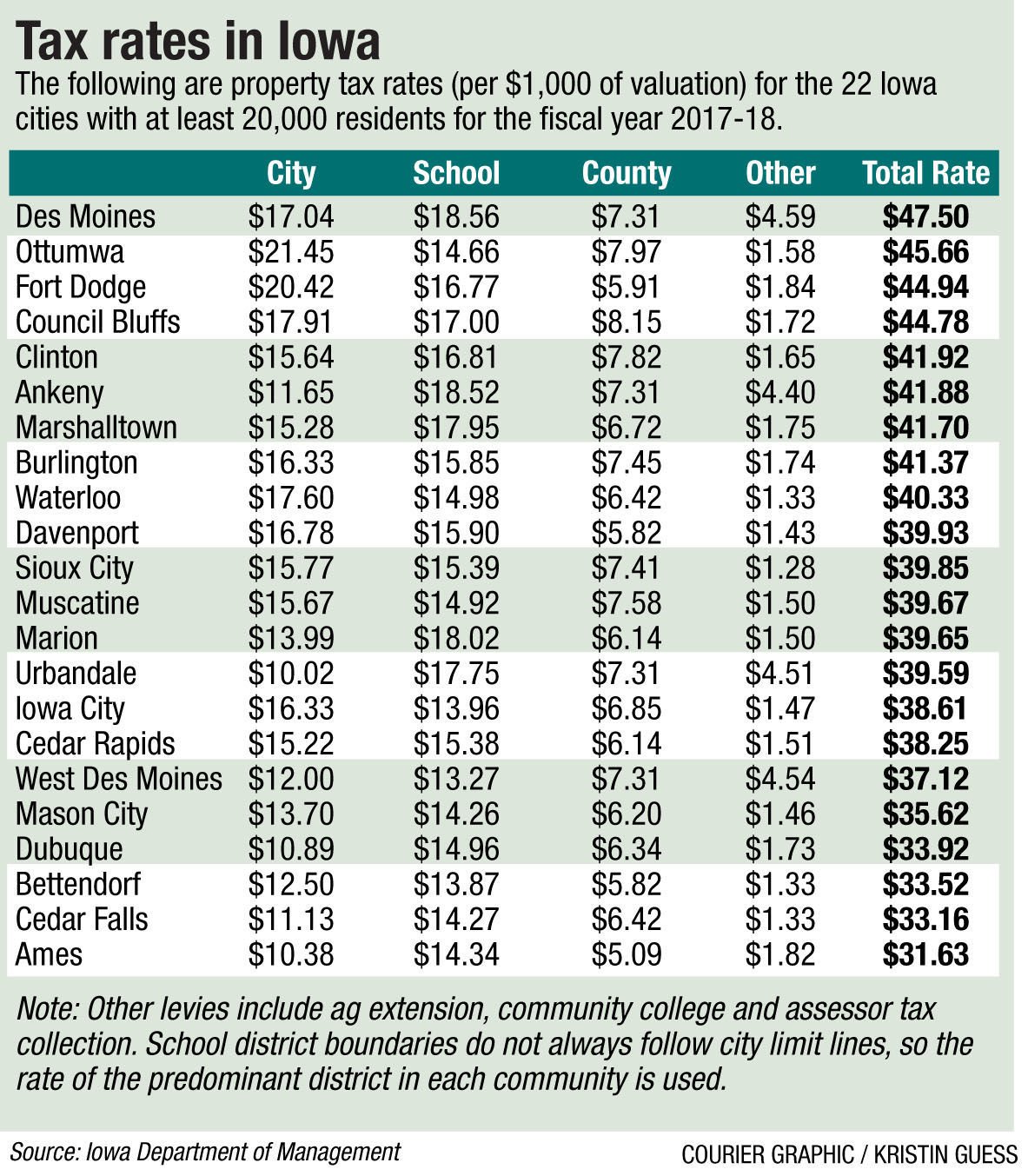

Waterloo tax rate falls, Cedar Falls up Political News

Property Tax Rate Butler County Pa Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The following tax types are shown as a result of a search: Delinquent taxes due county wide. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The county and municipal property tax bills are sent out on march. The property and revenue office generates over 30 million. Current taxes due in the districts for which the. Welcome to the butler county property and revenue department webpage! The assessment department generates the property tax bills for the county, municipalities, and school districts.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate Butler County Pa The property and revenue office generates over 30 million. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The following tax types are shown as a result of a search: The assessment department generates the property tax bills for the county, municipalities, and school districts. Current taxes due. Property Tax Rate Butler County Pa.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Property Tax Rate Butler County Pa Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Welcome to the butler county property and revenue department webpage! The following tax types are shown as a result of a search: Current taxes due. Property Tax Rate Butler County Pa.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate Butler County Pa Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. The following tax types are shown as a result of a search: Current taxes due in the districts for which the. Welcome to the butler county property and revenue department webpage! Butler county real estate tax is 21.7750 mills, plus 2.9160. Property Tax Rate Butler County Pa.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate Butler County Pa See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The following tax types are shown as a result of a search: The property and revenue office generates over 30 million. Welcome to the butler county property and revenue department webpage! Current taxes due in the districts for which the. Butler county real estate. Property Tax Rate Butler County Pa.

From www.neighborhoodscout.com

Butler, PA Crime Rates and Statistics NeighborhoodScout Property Tax Rate Butler County Pa See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler. Property Tax Rate Butler County Pa.

From fredbdanielle.pages.dev

Tax Free Weekend 2024 Iowa Laina Mirabel Property Tax Rate Butler County Pa Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The county and municipal property tax bills are sent out on march. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The median property tax (also known as real estate tax) in. Property Tax Rate Butler County Pa.

From itrfoundation.org

Property Tax Protection Through Local Government Limits ITR Foundation Property Tax Rate Butler County Pa The assessment department generates the property tax bills for the county, municipalities, and school districts. The property and revenue office generates over 30 million. The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. The following tax types are shown as a result of a. Property Tax Rate Butler County Pa.

From www.msn.com

When will you learn your latest Summit County property tax rate Property Tax Rate Butler County Pa The county and municipal property tax bills are sent out on march. The following tax types are shown as a result of a search: Welcome to the butler county property and revenue department webpage! The median property tax (also known as real estate tax) in butler county is $2,035.00 per year, based on a median home value of $159,000.00. Current. Property Tax Rate Butler County Pa.

From www.journal-news.com

Butler County property taxes likely jumping for some now that the Property Tax Rate Butler County Pa Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. The county and municipal property tax bills are sent out on march. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. See detailed property tax information from the sample. Property Tax Rate Butler County Pa.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate Butler County Pa The county and municipal property tax bills are sent out on march. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Delinquent taxes due county wide. Welcome to the butler county property and revenue department webpage! Our butler county property tax calculator can estimate your property taxes based on similar properties, and show. Property Tax Rate Butler County Pa.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate Butler County Pa Current taxes due in the districts for which the. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The county and municipal property tax bills are sent out on march. Delinquent taxes due county wide. Welcome to the butler county property and revenue department webpage! See detailed property. Property Tax Rate Butler County Pa.

From azmemory.azlibrary.gov

Average statewide property tax rates 2008 Arizona Memory Project Property Tax Rate Butler County Pa See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Our butler county property tax calculator can estimate your property taxes based on similar properties, and show you how. Delinquent taxes due county wide. The property and revenue office generates over 30 million. Current taxes due in the districts for which the. The following. Property Tax Rate Butler County Pa.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Property Tax Rate Butler County Pa Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The county and municipal property tax bills are sent out on march. The property and revenue office generates over 30 million. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The following. Property Tax Rate Butler County Pa.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate Butler County Pa Welcome to the butler county property and revenue department webpage! Delinquent taxes due county wide. The county and municipal property tax bills are sent out on march. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. The property and revenue office generates over 30 million. The assessment department generates the property tax bills. Property Tax Rate Butler County Pa.

From dailymontanan.com

Taxpayers mad about high property appraisals, but officials argue tax Property Tax Rate Butler County Pa See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. The property and revenue office generates over 30 million. The county and municipal property tax bills are sent out on march. The following. Property Tax Rate Butler County Pa.

From local12.com

Butler County property taxes likely to rise as rollbacks expire Property Tax Rate Butler County Pa The property and revenue office generates over 30 million. Delinquent taxes due county wide. The county and municipal property tax bills are sent out on march. Current taxes due in the districts for which the. See detailed property tax information from the sample report for 515 jennifer ln, butler county, pa. Butler county real estate tax is 21.7750 mills, plus. Property Tax Rate Butler County Pa.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate Butler County Pa Current taxes due in the districts for which the. Welcome to the butler county property and revenue department webpage! The property and revenue office generates over 30 million. The county and municipal property tax bills are sent out on march. The following tax types are shown as a result of a search: Our butler county property tax calculator can estimate. Property Tax Rate Butler County Pa.

From www.slideserve.com

PPT Steven Brewer Tips For Building a Home When Moving to Texas Property Tax Rate Butler County Pa Delinquent taxes due county wide. The following tax types are shown as a result of a search: The assessment department generates the property tax bills for the county, municipalities, and school districts. Butler county real estate tax is 21.7750 mills, plus 2.9160 mills for debt service plus, 2.9350 mills for butler county community. Current taxes due in the districts for. Property Tax Rate Butler County Pa.